Stock Market Training

STOCK MARKET TRAINING

"Stock market training" typically refers to the process of educating individuals about the functioning of the stock market, investment strategies, financial analysis, risk management, and trading techniques. It's aimed at helping participants develop the knowledge and skills necessary to navigate the complexities of the stock market effectively.

Understanding and managing risk is crucial in investing. Stock market training teaches participants various risk management techniques such as diversification, position sizing, stop-loss orders, and hedging strategies.

Here's a breakdown of what stock market training involve

Training often starts with fundamental concepts such as what a stock is, how the stock market operates, the role of stock exchanges, and the factors that influence stock prices.

Different investment strategies are discussed, including value investing, growth investing, dividend investing, and momentum trading. Participants learn about the principles behind these strategies and how to apply them effectively.

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Training in technical analysis covers chart patterns, technical indicators, and trend analysis techniques.

Fundamental analysis involves evaluating a company's financial health, performance, management, and competitive positioning to determine its intrinsic value. Participants learn how to analyze financial statements, assess industry trends, and conduct company research.

Understanding and managing risk is crucial in investing. Stock market training teaches participants various risk management techniques such as diversification, position sizing, stop-loss orders, and hedging strategies.

Emotions play a significant role in trading decisions. Training may cover topics related to investor psychology, including cognitive biases, emotional control, and the importance of discipline and patience in trading.

Participants learn about market dynamics, including supply and demand forces, market cycles, and the impact of macroeconomic factors such as interest rates, inflation, and geopolitical events on stock prices.

Training often includes familiarization with trading platforms, software tools, and data sources used for market analysis and execution of trades.

The stock market is dynamic, and new trends, technologies, and regulations continually emerge. Therefore, ongoing education and staying updated on market developments are essential components of stock market training.Stock market training can be delivered through various channels, including online courses, seminars, workshops, books, mentorship programs, and educational institutions offering finance and investment-related courses. The effectiveness of training largely depends on the quality of the content, the expertise of the instructors, and the commitment of participants to apply what they learn in real-world investing scenarios.

How to join us

Strategies every Trader must know:

Day trading strategy

Day trading strategy. Day trading or intraday trading is suitable for traders that would like to actively trade in the daytime,Having a day trading strategy written down is hugely important, as the day trader is faced with lots of random price movements that form multiple market.

Pairs trading

Pairs trading is finding the correlated pair of instruments where the valuation relationship has gone out of whack.Pairs trading is a popular trading strategy that involves identifying two correlated assets and simultaneously taking long and short positions in them.

Swing trading

The term 'swing trading' refers to trading both sides on the movements of any financial market.Swing trading is a popular trading strategy that involves aiming for quick profits resulting from short-term price movements

Scalping strategy

The scalping trading strategy involves making financial gains from small price changes. In this strategy, investors aim to extract profits from the most negligible trade with minor price changes in the hope.Traders who use a scalping strategy place very short-term trades with small price movements.

Momentum

Momentum trading has long been based on the idea that market trends continue for a while before they reverse.Momentum trading, in a nutshell, is buying what's going up and selling what's going down. As the name suggests, the basis of this Intraday Option Trading Strategy is to make the most of the momentum in the market.

Trend trading

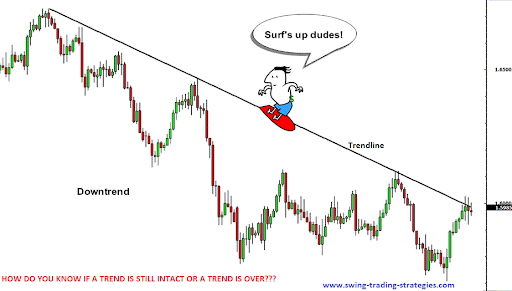

This strategy describes when a trader uses technical analysis to define a trend, and only enters trades in the direction.. A trend trading strategy relies on using technical analysis to identify the direction of market momentum.

Breakout trading

Breakout trading is the strategy of entering a given trend as early as possible, ready for the price to 'break out' of its range. Breakout and Reversal Trading Strategies. These next two aren't as dependent on holding periods. They're more about market conditions.

Strategy

Strategy is a general plan to achieve one or more long-term or overall goals under conditions of uncertainty.These are option strategies that expect a breakout of the spot price from a particular range.Based on the market trend, options trading strategies are also divided into three types; Bullish, Bearish, and Neutral Options Strategies

Open Demat and Trading Account with CMCL - OPEN DEMAT AND TRADING ACCOUNT

Why Open Demat and Trading Account with us ?

A Demat account helps investors hold shares and securities in an electronic format. It is also commonly known as a Dematerialised account. This account helps keep track of an investor's holdings in shares, exchange-traded funds, bonds, and mutual funds in one place.You can open a Demat account without a trading account. Sometimes an investor just wants to hold the shares over the long term without selling them in the near term. Such investors can store the shares in their Demat account.Safe and Secure: It provides a secure environment for storing your securities, reducing the risk of loss, theft, or damage associated with physical certificates. Convenience: Demat accounts offer easy access to your investments, allowing you to buy, sell, or transfer securities with just a few clicks.

An trading and demat account is most required for purchasing and selling and holding shares. However the trading and demat account could become dormant if there are sustained periods of inactivity. And no trade can be made through an dormant trading account until the reactivation process is completed.

CMCL Copyright© 2022. All right reserved.

Design & Developed by Erainfotech